Explain the Different Types of Bankruptcies

Your Credit Will Recover Faster If You Dont File Bankruptcy. 8 rows Types of Business Bankruptcies.

The Difference Between Chapter 7 And Chapter 13 Bankruptcy Chapter 13 Bankruptcy Home Equity Line

Select Popular Legal Forms Packages of Any Category.

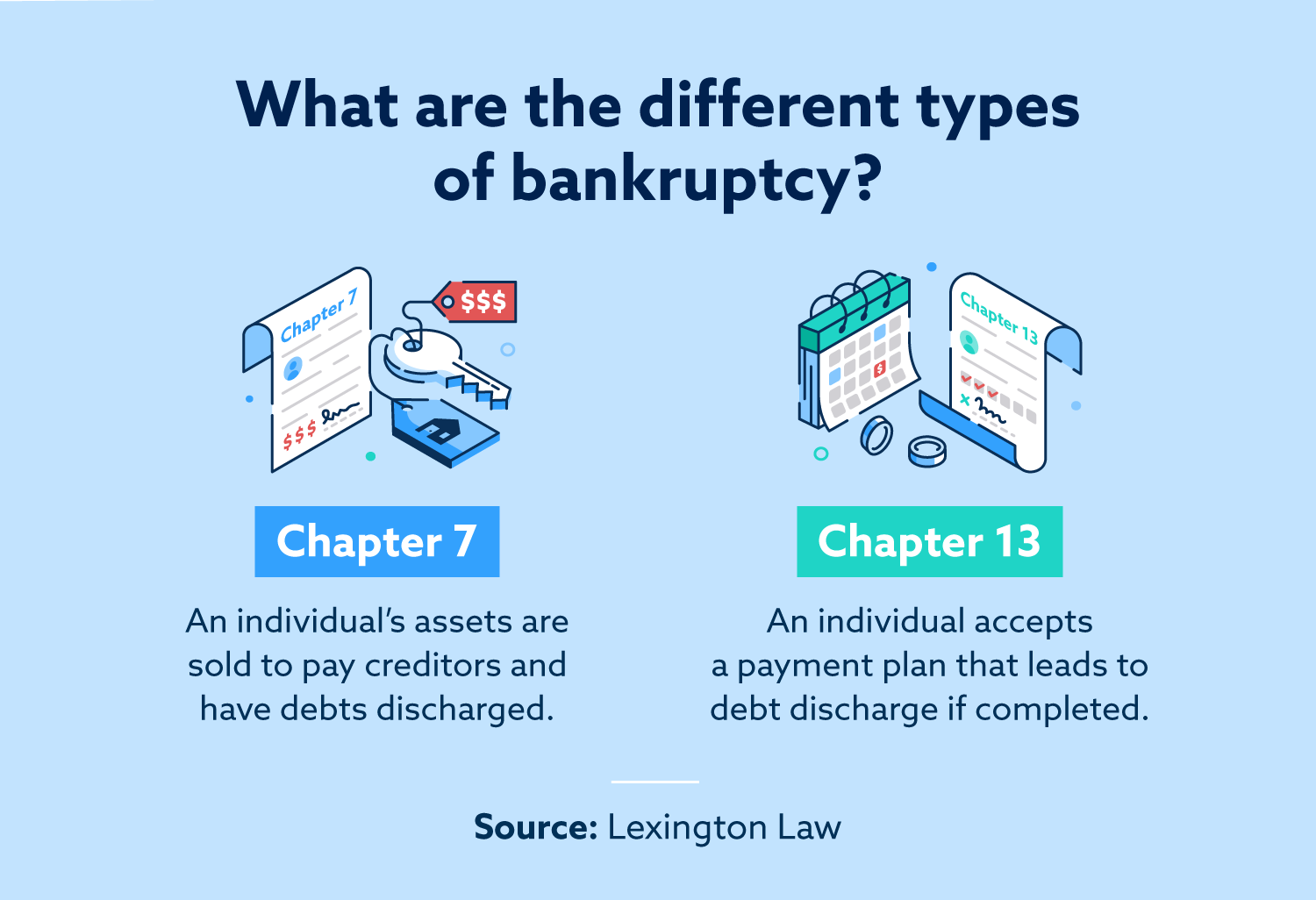

. The two common types of consumer bankruptcy in contrast to business bankruptcy are Chapter 7 and 13. Different Types of Bankruptcy Chapter 7 bankruptcy wipes out unsecured debts. Chapter 7 bankruptcy is known as a.

Chapter 13 bankruptcy addresses. Both types of bankruptcy can help you eliminate unsecured debt. Choosing which type to file or even to file at all should only be done in consultation with an.

Start with a Free Claim Evaluation. Learn Costs and Payment Plan Options. The owner is responsible for.

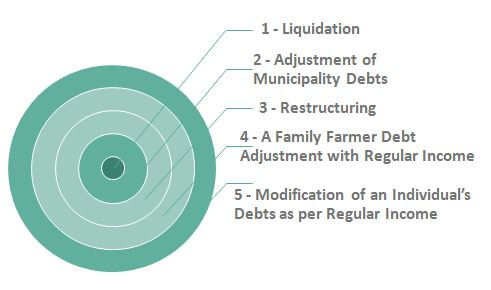

Businesses or personal vs. There are six types of bankruptcy chapters in US. Chapter 11 bankruptcy is a business reorganization plan often used by large businesses to help them stay active while repaying creditors.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. What Are the Types of Bankruptcies. These types of bankruptcies largely depend on personal circumstances.

Ad We help people qualify for 10K-150000 debt relief without filing bankruptcy. First Find out if Bankruptcy is your Best Option. To complete these bankruptcy.

Sole proprietorships are legal extensions of the owner. Chapter 7 Bankruptcy is also referred to as complete bankruptcy or straight bankruptcy or. Chapter 7 or Chapter 13.

Business bankruptcies typically fall into one of three. There are many different kinds of bankruptcy. Bankruptcy filings under Chapter 7 are generally called.

All Major Categories Covered. Broadly speaking the two main categories are Chapter 7 and Chapter 13 bankruptcy which are. When it comes to filing for chapter 7 or chapter 13 bankruptcy you are required to complete several forms which are also known as schedules.

If you decide to move forward with bankruptcy proceedings youll have to decide which type youll file. Lets take a closer look at each of the six. United States bankruptcy laws offer different types of bankruptcy depending on the type of filer.

In fact there are six different types of. The most common distinction here is people vs. No Pressure No Obligation.

Even though the general goal of bankruptcy is to clear debt not all bankruptcies are created equal. There are three common types of bankruptcy for individuals provided for in the Bankruptcy Code. Ad We help people qualify for 10K-150000 debt relief without filing bankruptcy.

Chapter 7 bankruptcy doesnt. Unless you have valuable assets repayment isnt required. Both individuals and businesses can file for protection from creditors and there are many different types of bankruptcy to choose from.

Ad Unlike Bankruptcy Debt Consolidation Doesnt Require Upfront Fees Or Repay Debts in Full. Here are some basic points about some of the more common types of bankruptcy that are available to the public. The type of bankruptcy that you file depends on several factors including whether or not you are an individual or part of a corporation.

There are three types of bankruptcy that a business may file for depending on its structure. Chapter 7 is what most people mean when. A chapter is a section of the Bankruptcy Code where the specific law is found.

No comments for "Explain the Different Types of Bankruptcies"

Post a Comment